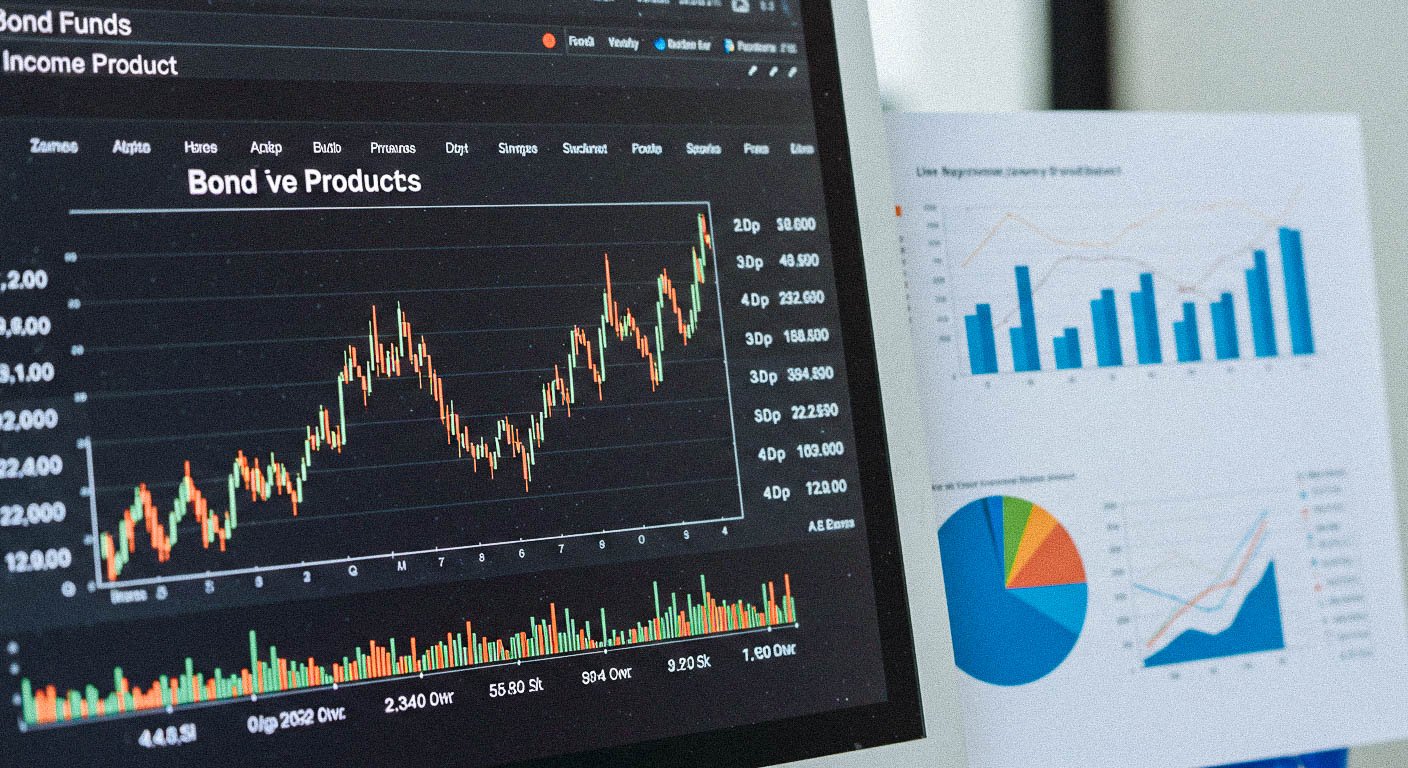

In an uncertain economic environment, investors are increasingly seeking low-risk investments that provide stable returns. Bonds and financial products have become attractive options, offering predictable income, lower volatility, and capital preservation.

This article explores a strategic approach to investing in bonds and financial products, including portfolio allocation, recommended funds, and risk management techniques tailored for U.S. and European investors.

1. Why Consider Bonds and Financial Products?

1.1 Market Volatility and the Need for Safe Assets

Stock markets remain volatile due to economic uncertainty, inflation, and interest rate fluctuations. In contrast, bonds and financial products offer a steady stream of income and reduced exposure to market downturns.

- Bonds provide fixed interest payments, ensuring a stable income stream

- Financial products such as money market funds and fixed deposits offer capital security

- Less exposure to market shocks compared to equities

1.2 The Impact of Interest Rates on Bonds

Interest rate movements have a direct impact on bond performance.

- When interest rates rise, new bonds offer higher yields, increasing income potential

- When interest rates fall, existing bonds appreciate in value, providing capital gains

Given the current interest rate environment, investing in a diversified bond portfolio can be a reliable strategy for generating consistent returns.

2. Portfolio Strategy for Stable Income

A well-structured portfolio balances low-risk government bonds, investment-grade corporate bonds, and high-yield assets.

2.1 Recommended Portfolio Allocation

| Investment Type | Allocation | Expected Yield |

|---|---|---|

| Government Bonds (U.S. Treasuries, European Sovereign Bonds) | 40% | 4-5% |

| Investment-Grade Corporate Bonds | 30% | 5-6% |

| High-Yield Bonds | 20% | 7-9% |

| Money Market Funds & Fixed Deposits | 10% | 3-4% |

2.2 Key Portfolio Considerations

- Government bonds provide stability and protect against market downturns

- Investment-grade corporate bonds offer higher yields while maintaining credit quality

- High-yield bonds introduce risk but enhance overall returns

- Money market funds and fixed deposits ensure liquidity and capital preservation

This balanced approach allows investors to achieve stable returns while managing risk effectively.

3. Top Bond & Financial Products for Secure Investment

Selecting the right financial products is essential for maximizing returns while minimizing risk.

3.1 Government Bonds

- U.S. Treasury Bonds

- Considered one of the safest investments globally

- Suitable for capital preservation and steady income

- European Government Bonds

- Issued by major European economies

- Offer diversification benefits alongside U.S. Treasuries

3.2 Corporate Bonds

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

- Focuses on investment-grade bonds from major corporations

- Provides yields of 5-6%

- SPDR Bloomberg High Yield Bond ETF (JNK)

- Composed of high-yield (junk) bonds for enhanced returns

- Higher risk but offers yields of 7-9%

3.3 Financial Products

- Fixed Deposits (Certificates of Deposit – CDs)

- Capital-protected with fixed interest rates

- Bank-dependent rates, making comparison essential

- Money Market Funds (MMFs)

- Short-term instruments such as Treasury bills and commercial paper

- Offer higher liquidity than traditional savings accounts

By combining these investment options, investors can create a well-balanced portfolio with consistent income.

4. Risk Management Strategies for Bond & Financial Product Investors

While bonds and financial products are generally safe, they still involve risks. Managing these risks ensures long-term stability.

4.1 Interest Rate Risk

- Rising interest rates can decrease the market value of existing bonds

- Short-duration bonds help mitigate this risk

4.2 Credit Risk

- Corporate and high-yield bonds carry default risk

- Focus on investment-grade bonds for stability

4.3 Currency & Inflation Risk

- International bonds are subject to currency fluctuations

- Inflation can erode real returns, making inflation-protected bonds (TIPS) a viable option

A well-diversified portfolio helps minimize these risks while maintaining a steady income stream.

5. Who Should Invest in Bonds & Financial Products?

- Investors seeking predictable income streams with low volatility

- Retirees looking for stable interest earnings

- Individuals wanting to diversify away from stock market fluctuations

Bonds and financial products are ideal for capital preservation and long-term income generation.