Many people struggle to save money because they spend first and try to save whatever is left—which is often nothing. One effective solution is to set up an Automated Savings Plan. However, the most successful savers follow a different approach: they save first and spend what’s left.

By setting up an automated savings system, you can eliminate the hassle of manual transfers and ensure that your financial goals are consistently met.

In this guide, we’ll cover why automated savings works, how to set it up, and the best strategies to maximize your savings over time.

1. Why Is Automated Savings Effective?

The biggest challenge in saving money is consistency.

By automating your savings, you remove the temptation to spend and create a habit of saving without even thinking about it.

📌 Benefits of Automated Savings

✅ Forces you to save – Your money is set aside before you can spend it

✅ Reduces decision fatigue – No need to manually transfer funds each month

✅ Helps build long-term wealth – The earlier you start, the more you benefit from compound interest

✅ Makes saving for multiple goals easier – Separate funds for different purposes

💡 According to a study by the Consumer Financial Protection Bureau, individuals who automate their savings save 30% more than those who save manually.

2. How to Set Up an Effective Automated Savings System

1) Define Your Financial Goals

Before setting up automated transfers, you need to determine what you’re saving for and how much you need.

📌 Examples of Savings Goals

✔ Emergency Fund – 3 to 6 months of living expenses

✔ Home Down Payment – Save at least 20% to avoid private mortgage insurance (PMI)

✔ Travel Fund – Set aside a fixed amount monthly for vacations

✔ Retirement Savings – Take advantage of employer-sponsored plans like a 401(k)

💡 Having clear financial goals helps you stay motivated and track progress more effectively.

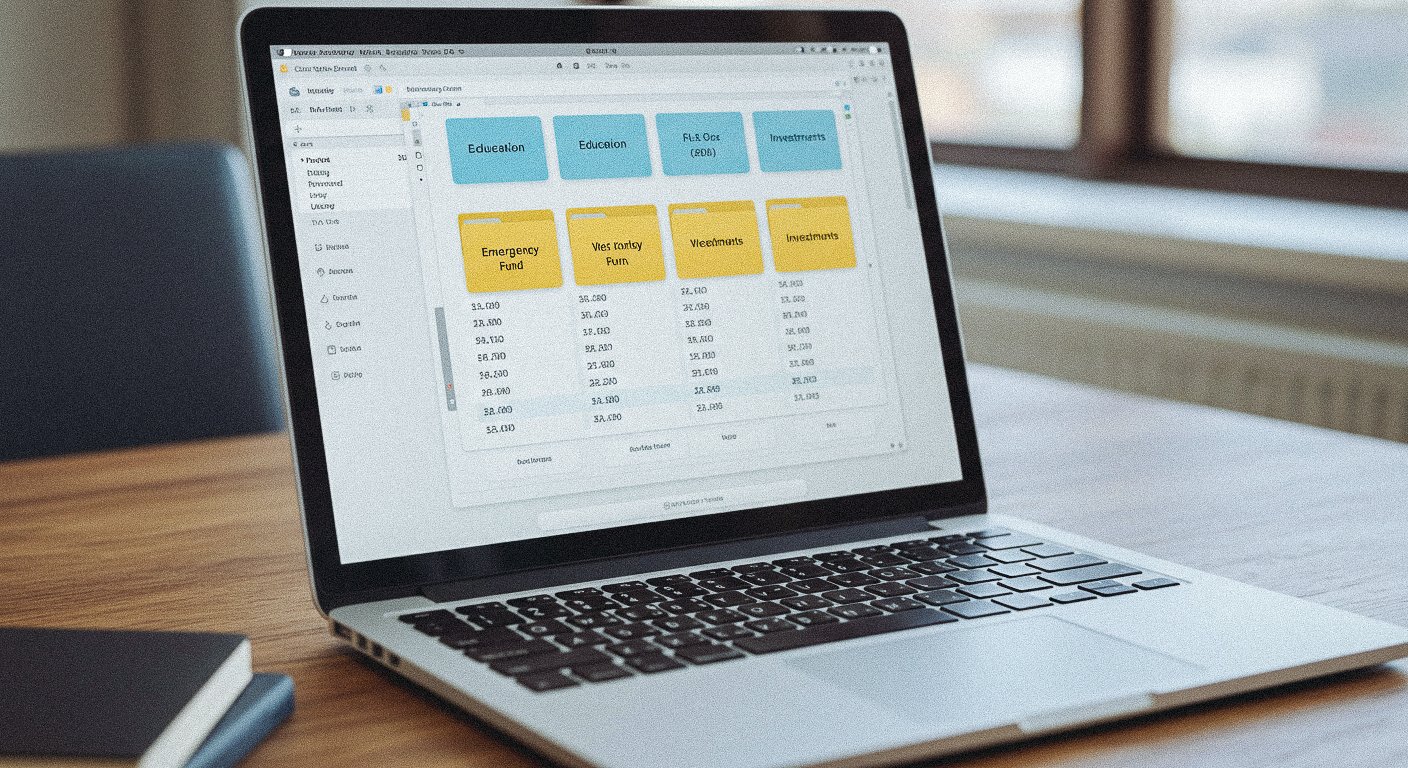

2) Open Separate Savings Accounts for Different Goals

Keeping all your money in one account makes it too easy to dip into savings for everyday expenses.

To prevent this, use multiple accounts to separate your savings.

📌 Recommended Account Structure

✅ Checking Account – For everyday expenses & bill payments

✅ Emergency Fund Account – A high-yield savings account for unexpected expenses

✅ Short-Term Goals Account – For vacations, car purchases, or home renovations

✅ Long-Term Investment Account – For retirement savings, ETFs, and stocks

💡 Financial experts recommend at least three dedicated savings accounts to stay organized and maximize savings efficiency.

3) Set Up Automatic Transfers

📌 Best Practices for Automated Transfers

✅ Schedule transfers on payday – Move money before you have a chance to spend it

✅ Start with a small percentage – Begin with 10% of your income and increase over time

✅ Increase savings annually – Adjust contributions by 3–5% every year

💡 People who automate their savings are 50% more likely to reach their financial goals, according to a 2023 Fidelity study.

3. Maximizing Your Automated Savings Plan

1) Use High-Yield Savings Accounts & CDs

✅ High-Yield Savings Accounts – Earn more interest than traditional accounts

✅ Certificates of Deposit (CDs) – Lock in higher rates for fixed periods

💡 With a high-yield savings account offering 4% APY, saving $500 monthly can grow to over $31,000 in five years.

2) Automate Investing for Wealth Growth

✅ 401(k) Contributions – Many employers match up to 5–6% of salary—take full advantage

✅ Robo-Advisors & ETFs – Automate investments for long-term wealth growth

💡 A $200 monthly investment in an S&P 500 ETF averaging 8% returns can grow to over $150,000 in 30 years.

3) Use Round-Up Savings Apps

✅ Apps like Acorns or Chime round up purchases and save the difference

✅ Over time, small amounts add up to substantial savings

💡 Rounding up just $1 per day can result in over $350 in savings annually.

4. Conclusion – The Power of Automated Savings

✔ Automated savings ensures you consistently save money before spending it.

✔ Using separate accounts for different goals makes financial planning easier.

✔ Leveraging high-yield savings and investment accounts helps maximize growth.

✔ Starting small and increasing savings over time builds long-term financial security.

📌 How do you save money? Share your best tips in the comments!