Stock investing is more than just a way to make quick money — it’s a long-term strategy for building wealth, planning for retirement, and achieving financial freedom. Yet, despite its popularity, many new investors enter the market without proper knowledge and end up facing losses early on.

In this guide, we’ll explore the fundamentals of the stock market, how investors actually make money, key terminology, strategies, and investor psychology — all based on current 2025 market conditions.

1. What Is a Stock?

A stock represents partial ownership of a company. When you buy shares, you’re effectively purchasing a piece of that business. This entitles you to a portion of the company’s future profits — either through capital appreciation (price growth) or dividends.

For example, owning 100 shares of Apple means you are a part-owner of the company, and if Apple grows, your shares will rise in value. You may also receive dividend payments as a shareholder.

2. How Do You Make Money from Stocks?

1) Capital Gains (Price Appreciation)

Buy low, sell high — the oldest strategy in the book. If you buy a stock at $50 and sell it at $75, your capital gain is $25 per share.

According to market data, average annual returns in the U.S. stock market range between 7–10%, but over 60% of first-year retail investors experience losses due to lack of strategy and market timing.

2) Dividend Income

Some companies pay part of their profits to shareholders in the form of dividends, offering consistent income.

Typical dividend yields range between 2–5% annually, with blue-chip companies like Coca-Cola, Johnson & Johnson, and Procter & Gamble known for stable payouts.

3. Key Stock Market Terms to Know

- Buy/Sell (Order Types): Placing a trade to purchase or sell a stock

- Open/Close Price: The first and last traded prices during a market session

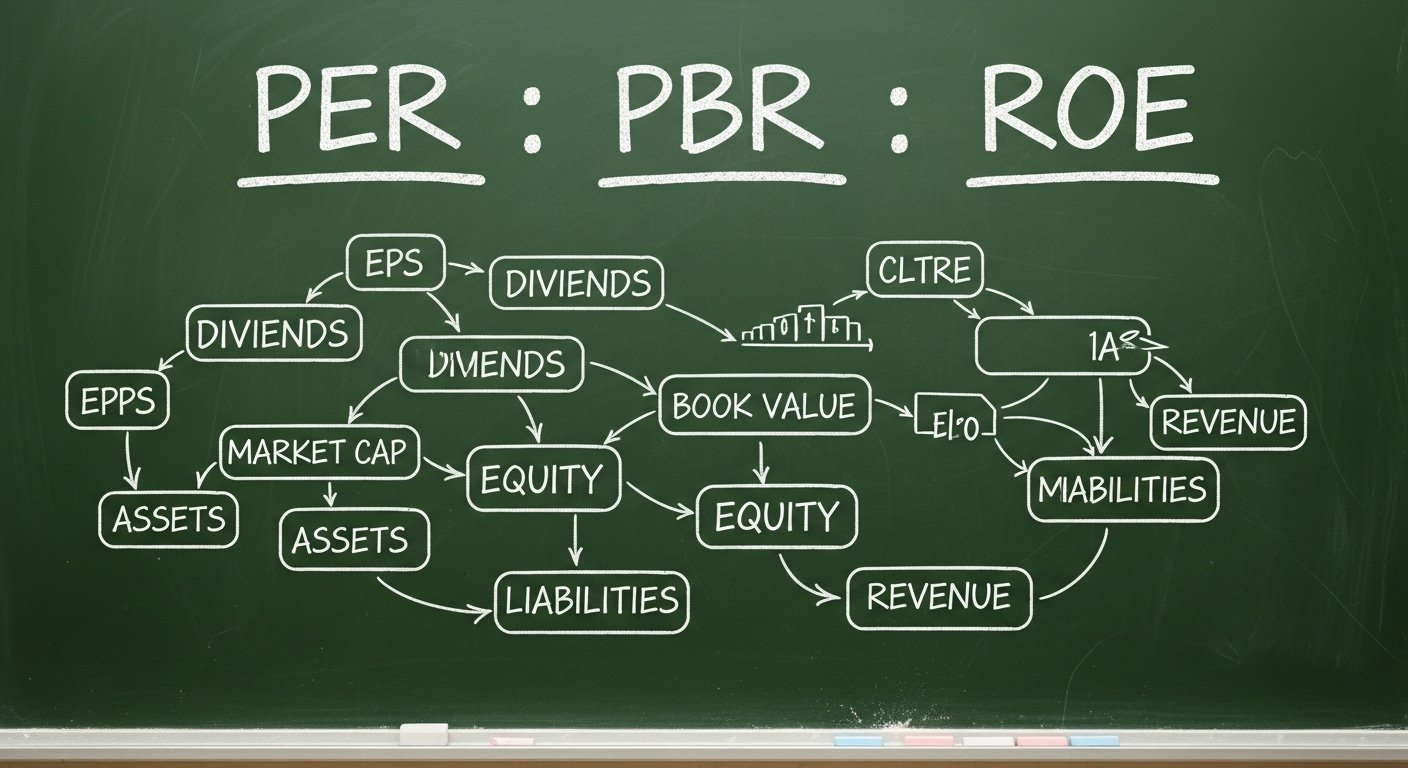

- P/E Ratio (Price to Earnings): Share price divided by earnings per share; a common valuation metric

- P/B Ratio (Price to Book): Share price divided by book value per share; measures asset-based valuation

- Volume: Number of shares traded over a given time

- Bid/Ask Spread: The difference between the buyer’s price and the seller’s price

4. Basic Principles of Successful Investing

1) Diversification

Don’t put all your eggs in one basket. Spread investments across different sectors, industries, and regions.

According to MSCI research, diversified portfolios experience 40% lower volatility and 20% higher long-term returns compared to non-diversified ones.

2) Long-Term Focus

Investing over time (3–5 years minimum) yields better results than attempting short-term market timing.

A 2022 Vanguard study showed investors with a clear, long-term plan outperformed spontaneous traders by 2.2% annually.

3) Research-Driven Decisions

Use publicly available resources like SEC filings (EDGAR), earnings reports, and industry data. Avoid impulsive buying based on trends or hype.

4) Risk & Capital Management

Only invest what you can afford to lose. Avoid using emergency savings or taking on debt to invest.

5. Understanding the Market: Indexes & Analysis Methods

Stock Market Indexes (as of October 2025):

- S&P 500: 4,600–4,800 range

- NASDAQ: 14,500–15,300

- Dow Jones: 38,000–39,500

Analysis Methods:

- Fundamental Analysis: Analyzing financial statements, company performance, and macroeconomic trends

- Technical Analysis: Evaluating historical price and volume data to forecast future price movements

- Valuation Ratios: Use P/E, P/B, and PEG ratios to assess a stock’s fair value

6. Investing Strategies & Styles

1) Value Investing

Buying undervalued stocks with strong fundamentals. Think Warren Buffett-style investing.

2) Growth Investing

Targeting companies with high revenue and earnings growth potential.

In 2025, sectors like AI, green energy, semiconductors, and biotech are popular among growth investors.

3) Technical Trading

Relying on price charts, indicators, and patterns (like MACD, RSI, Bollinger Bands) for entry and exit timing.

4) Sector Rotation

Switching investments based on economic cycles — tech and finance in booms, healthcare and utilities during slowdowns.

7. Investor Psychology & Behavior Types

- Conservative Investor: Prefers dividends, blue-chip stocks, and stability

- Aggressive Investor: Looks for fast-growing, high-volatility stocks

- Speculative Trader: Trades based on short-term price moves and momentum

A study by Dalbar found that emotion-driven investors underperform the market by 3–4% per year. Controlling fear, greed, and overconfidence is crucial for success.

8. Practical Investing Tips for Beginners

- Set Specific Goals: “Grow $10,000 into $15,000 in 12 months”

- Use ETFs for Easy Diversification: e.g., Vanguard Total Market ETF (VTI), SPY

- Track Market News & Reports Regularly

- Create Entry & Exit Rules in Advance

- Use Stop-Loss Orders to Limit Downside Risks

📊 Key 2025 Market Data Summary

| Indicator | Value | Source |

|---|---|---|

| New Investors Losing Money in Year 1 | Over 60% | FINRA, 2024 |

| Diversification Reduces Volatility By | ~40% | MSCI Global |

| Diversified Portfolios Have Higher Returns By | ~20% | MSCI Global |

| Average P/E of S&P 500 | 17–20 | Bloomberg |

| KOSPI Index (for comparison) | 2,500–2,700 | Korea Exchange |

| Investor Psychology Impact on Returns | -3% to -4% | Dalbar, 2023 |

Final Thoughts: How to Start Investing in 2025

The U.S. stock market in 2025 is shaped by emerging technologies, interest rate cycles, and global economic shifts.

Whether you’re a conservative dividend investor or a high-risk growth trader, having a clear strategy, strong fundamentals, and emotional discipline is more important than ever.

Start with what you know, continue learning, and stay consistent. Smart investing is a marathon — not a sprint.