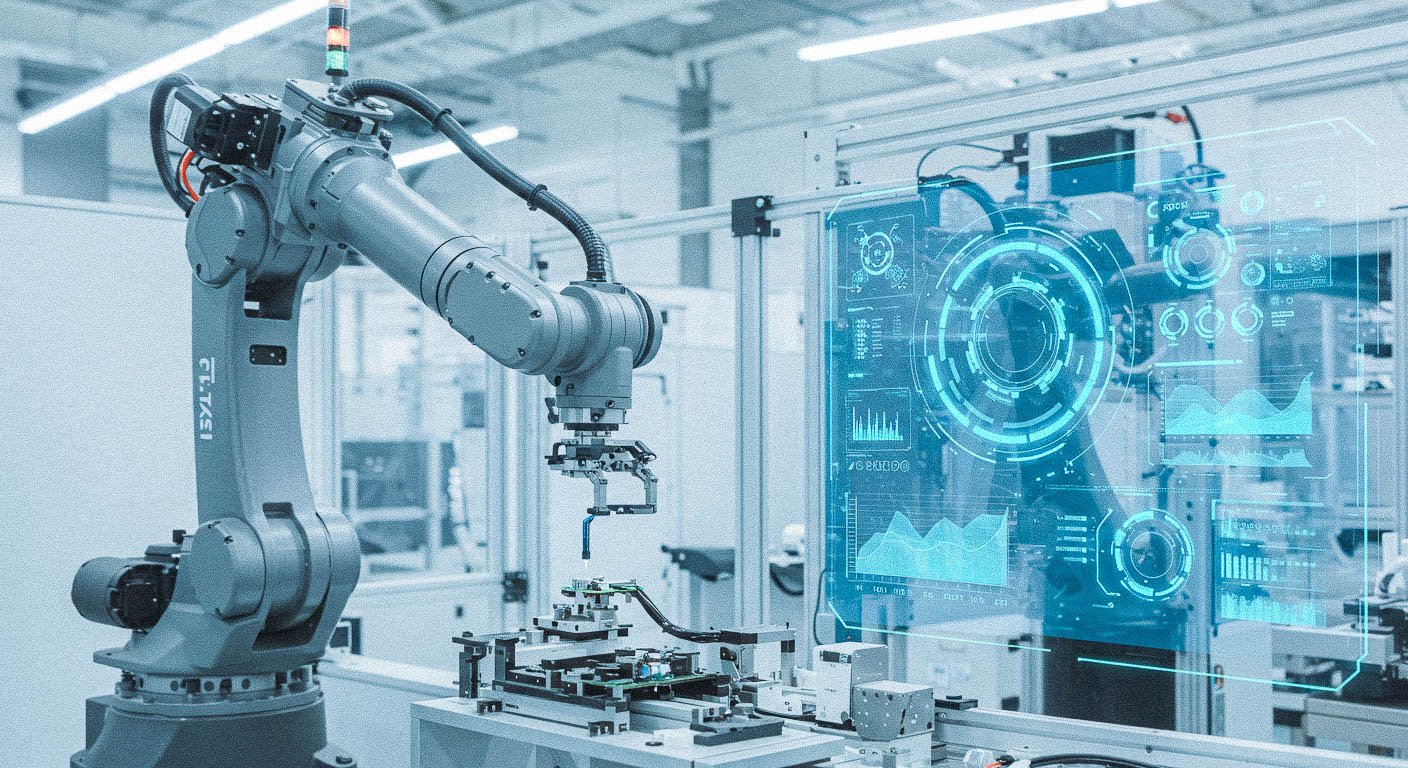

The artificial intelligence (AI) and robotics industries are experiencing rapid growth, driven by automation, machine learning, and advanced robotics technologies. From self-driving cars to robotic surgeries, AI-powered solutions are transforming various sectors, including manufacturing, healthcare, logistics, and finance.

Investing in AI & robotics ETFs (exchange-traded funds) is one of the most efficient ways to gain exposure to this booming market without picking individual stocks. ETFs allow you to diversify risk while benefiting from industry-wide growth.

In this guide, we’ll explore top AI & robotics ETFs, practical investment strategies, and key risk management techniques to help you build wealth over the next three years.

📌 Why Invest in AI & Robotics ETFs Now?

1️⃣ AI & Robotics Market Growth

✔ Automation is accelerating → Companies across industries are integrating AI and robotics to cut costs and increase efficiency.

✔ AI technology is improving rapidly → Developments in natural language processing (NLP), generative AI, and robotics are driving adoption.

✔ Governments are investing heavily → The U.S., Europe, and China are funding AI and automation initiatives to stay competitive.

📊 Market Outlook:

- The global AI market is projected to reach $1.8 trillion by 2030, up from $200 billion in 2023 (PwC).

- The robotics industry is expected to grow at a CAGR of 10%, reaching $300 billion by 2028.

💡 Investment Insight: AI & robotics are long-term growth industries, making now an ideal time to start investing.

📌 Top 3 AI & Robotics ETFs to Watch

Investing in AI & robotics ETFs allows you to gain exposure to multiple companies driving the future of automation and machine learning. Here are three top-performing ETFs to consider:

1️⃣ Global X Robotics & Artificial Intelligence ETF (BOTZ)

✅ Key Holdings: NVIDIA, ABB, Intuitive Surgical

✅ 3-Year Average Return: ~18%

✅ Why Invest?

- Focuses on AI, industrial automation, and medical robotics

- Includes leading semiconductor companies like NVIDIA

💡 Best for investors looking for broad exposure to AI & robotics.

2️⃣ ARK Autonomous Technology & Robotics ETF (ARKQ)

✅ Key Holdings: Tesla, Unity, JD.com

✅ 3-Year Average Return: ~15%

✅ Why Invest?

- Actively managed ETF focusing on autonomous vehicles, drones, and AI software

- Higher risk, but potential for high growth

💡 Best for investors who want exposure to disruptive AI-driven technologies.

3️⃣ iShares Robotics and Artificial Intelligence ETF (IRBO)

✅ Key Holdings: Apple, Microsoft, Alphabet

✅ 3-Year Average Return: ~12%

✅ Why Invest?

- Broad exposure to AI-driven tech giants and smaller AI startups

- Balanced mix of large-cap and mid-cap AI innovators

💡 Best for long-term investors seeking a diversified AI & robotics ETF.

📌 How to Grow Your AI ETF Investment in 3 Years

1️⃣ Use Dollar-Cost Averaging (DCA)

Since AI & robotics stocks can be volatile, using dollar-cost averaging helps reduce risk.

📊 Example Strategy:

- Invest $500 per month into an AI ETF

- Over three years, your investment grows regardless of short-term market swings

💡 Why? Helps you avoid buying at market peaks and smooths out long-term gains.

2️⃣ Diversify Your Portfolio

Even though AI & robotics ETFs are promising, it’s essential to maintain a balanced portfolio.

📊 Example Portfolio Allocation:

- 40% AI & robotics ETFs (BOTZ, ARKQ, IRBO)

- 30% Broad market ETFs (S&P 500, Nasdaq 100)

- 20% Dividend & bond ETFs (for stability)

- 10% Cash (for buying opportunities)

💡 Why? A diversified portfolio reduces risk while allowing AI investments to grow.

3️⃣ Monitor Key AI & Robotics Trends

To maximize gains, stay updated on technological advancements, earnings reports, and regulatory changes.

✔ Track AI hardware innovations (e.g., NVIDIA’s AI chips)

✔ Follow autonomous vehicle development (Tesla, Waymo)

✔ Watch corporate AI adoption (Microsoft, Google AI)

💡 Why? Understanding industry shifts can help you make informed investment decisions.

📌 Risk Management: When to Adjust Your AI ETF Investment?

While AI & robotics ETFs offer strong growth potential, they can also experience short-term volatility. Here’s when to rebalance your investments:

✔ If AI ETFs surge over 40% in a year, consider taking partial profits and reallocating funds.

✔ If interest rates rise sharply, technology stocks may drop—adjust your exposure accordingly.

✔ If AI companies underperform earnings expectations, reassess your ETF holdings.

💡 Key Tip: Stick to your long-term strategy while adapting to market conditions.

📌 Who Should Invest in AI & Robotics ETFs?

✅ Investors looking for high-growth opportunities in emerging technology

✅ Long-term investors who can tolerate short-term volatility

✅ Those who prefer ETF diversification instead of picking individual AI stocks

AI & robotics ETFs provide an excellent way to capitalize on future technological advancements without excessive risk. By following a structured investment strategy, you can grow your wealth steadily over three years.