The IPO (Initial Public Offering) market is one of the most exciting opportunities for investors looking to capitalize on early-stage growth. Investing in newly public companies can yield significant returns, but not every IPO is a guaranteed success. Careful research and strategic investing are key to making the most out of these opportunities.

So, which companies are set to make a big splash in 2025? This article highlights the top 5 upcoming IPOs with strong growth potential and provides essential strategies for smart IPO investing. 💡

1. Understanding IPO Investing: How It Works and Why It Matters 🤔

🔹 What Is an IPO?

An IPO (Initial Public Offering) is the process by which a private company goes public by issuing shares on a stock exchange. Companies use IPOs to raise capital, while investors get the opportunity to buy in at the initial price before the stock starts trading on the open market.

📌 Key Benefits of IPO Investing

✅ Early-stage growth potential – IPO stocks often see rapid price increases after launch.

✅ Undervalued opportunities – Investing before a company gains mainstream attention.

✅ Institutional demand insight – Strong institutional interest signals a promising IPO.

💡 Example:

- A tech startup launches an IPO with an initial price of $50 per share.

- On the first trading day, it jumps to $75 per share (50% gain).

- Over the next year, the stock reaches $120 as the company expands.

👉 Strategic IPO investing requires selecting the right companies at the right time.

2. Key Factors to Consider Before Investing in an IPO 🔍

(1) Company Growth Potential

✅ Market size & competitive positioning

✅ Revenue and profit growth trends

✅ Innovation & unique value proposition

📌 Example: AI chipmakers and clean energy firms are poised for long-term expansion in 2025.

(2) Institutional Investor Demand

✅ High demand from hedge funds & mutual funds is a positive sign.

✅ Pre-IPO funding rounds and institutional backing.

📌 Example: An IPO with subscription demand of 1,000:1 is likely to perform well post-listing.

(3) Industry Trends & Market Conditions

✅ Favorable macroeconomic conditions & regulatory environment

✅ Sectors benefiting from strong tailwinds like AI, biotech, and fintech

📌 Example: In a low-interest-rate environment, growth stocks & tech IPOs tend to outperform.

👉 IPO investing isn’t just about hype; deep analysis is crucial for success.

3. Top 5 IPOs to Watch in 2025 🏆

The company names have been labeled as A, B, etc., because their IPO schedules have not been officially confirmed, or publicly sharing unverified information could lead to misunderstandings.

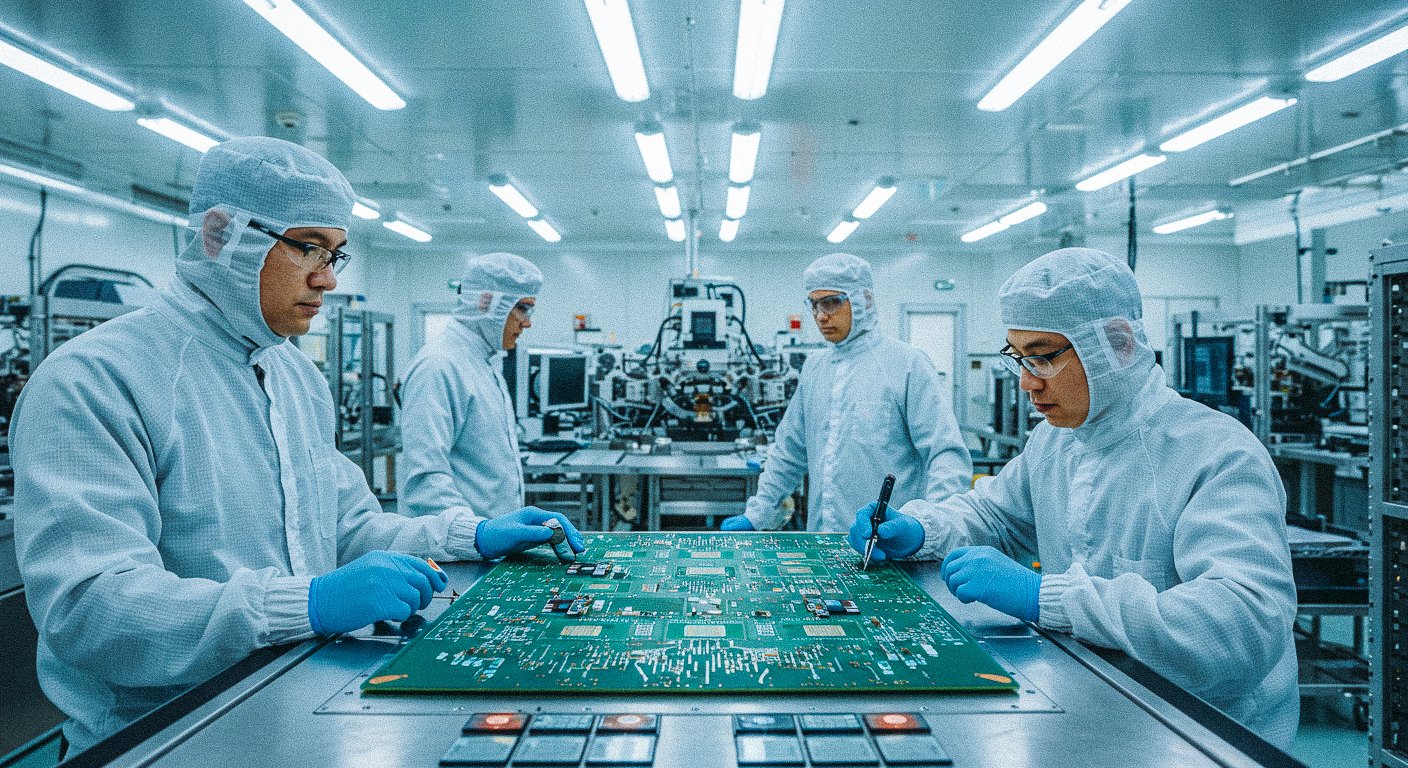

1) A – AI Semiconductor Powerhouse 🖥️🔍

📌 Company Overview

- Designs AI-powered semiconductor chips for data centers.

- Partners with major cloud computing firms.

- Annual revenue growth exceeding 50% for the past three years.

📌 IPO Highlights

✅ Strong demand for AI & cloud computing driving chip sales.

✅ High institutional investor interest.

✅ Expanding operations in the U.S. and Europe.

💡 Estimated IPO Valuation: $12 billion+

2) B – Cutting-Edge Biotech Firm 🧬💊

📌 Company Overview

- Specializes in next-gen cancer therapies & rare disease treatments.

- Multiple licensing deals with leading pharmaceutical firms.

- Currently in FDA Phase 3 trials for a breakthrough oncology drug.

📌 IPO Highlights

✅ FDA approval could send stock soaring.

✅ High demand for biotech IPOs in 2025.

✅ Strong intellectual property & clinical pipeline.

💡 Estimated IPO Valuation: $8 billion+

3) C – Next-Gen EV Battery Maker 🚗🔋

📌 Company Overview

- Pioneering solid-state battery technology for electric vehicles.

- Partnered with major automakers for next-gen battery supply.

- Positioned to benefit from government EV incentives.

📌 IPO Highlights

✅ Rapidly growing EV market boosting demand for advanced batteries.

✅ Higher energy density & faster charging technology.

✅ Potential for global expansion in the U.S., Europe, and China.

💡 Estimated IPO Valuation: $10 billion+

4) D – AI-Driven Digital Banking Platform 💳📲

📌 Company Overview

- Offers AI-powered financial services, including mobile banking & robo-advisors.

- Expanding globally with a focus on digital payments & lending.

- 90%+ YoY increase in transaction volume.

📌 IPO Highlights

✅ Fintech sector expected to see double-digit growth through 2030.

✅ High customer retention and scalable platform.

✅ IPO expected to attract strong institutional demand.

💡 Estimated IPO Valuation: $7 billion+

5) E – Global OTT Streaming Giant 🎬📡

📌 Company Overview

- Competes with Netflix, Disney+, and Amazon Prime in streaming services.

- Exclusive content deals & international expansion strategy.

- 200% growth in subscribers over the past three years.

📌 IPO Highlights

✅ Surging demand for premium streaming content.

✅ Strategic partnerships with Hollywood & international studios.

✅ Monetization through ads, subscriptions & licensing.

💡 Estimated IPO Valuation: $6 billion+

4. IPO Investment Strategies: How to Approach New Listings 🎯

✅ Short-Term Strategy

✔ Identify IPOs with high institutional interest.

✔ Target stocks with oversubscribed demand & first-day pop potential.

✅ Long-Term Strategy

✔ Focus on industries with strong secular growth trends.

✔ Choose companies with sustainable revenue and profit margins.

💡 Key Takeaway: IPO investing works best when combining short-term momentum plays with long-term value investing.