China’s economy is showing signs of recovery, drawing attention from global investors. At the same time, speculation is growing that China may lift the Hallyu (Korean Wave) ban, which could significantly impact South Korean businesses.

This article will analyze China’s economic rebound scenarios, key industries poised for growth, and the stocks that could benefit the most after the Hallyu ban is lifted. If you’re an investor looking for opportunities, this is what you need to know! 🚀

1. Is China’s Economy Really Recovering? 🔍

🔹 (1) China’s Economic Stimulus Measures

The Chinese government has rolled out major policies to stimulate the economy, stabilize the real estate sector, and boost domestic consumption.

📌 Key Policies in Place

✅ Consumer spending incentives – Increased subsidies for EVs, home appliances, and tourism

✅ Real estate market stabilization – Support for struggling developers, interest rate cuts

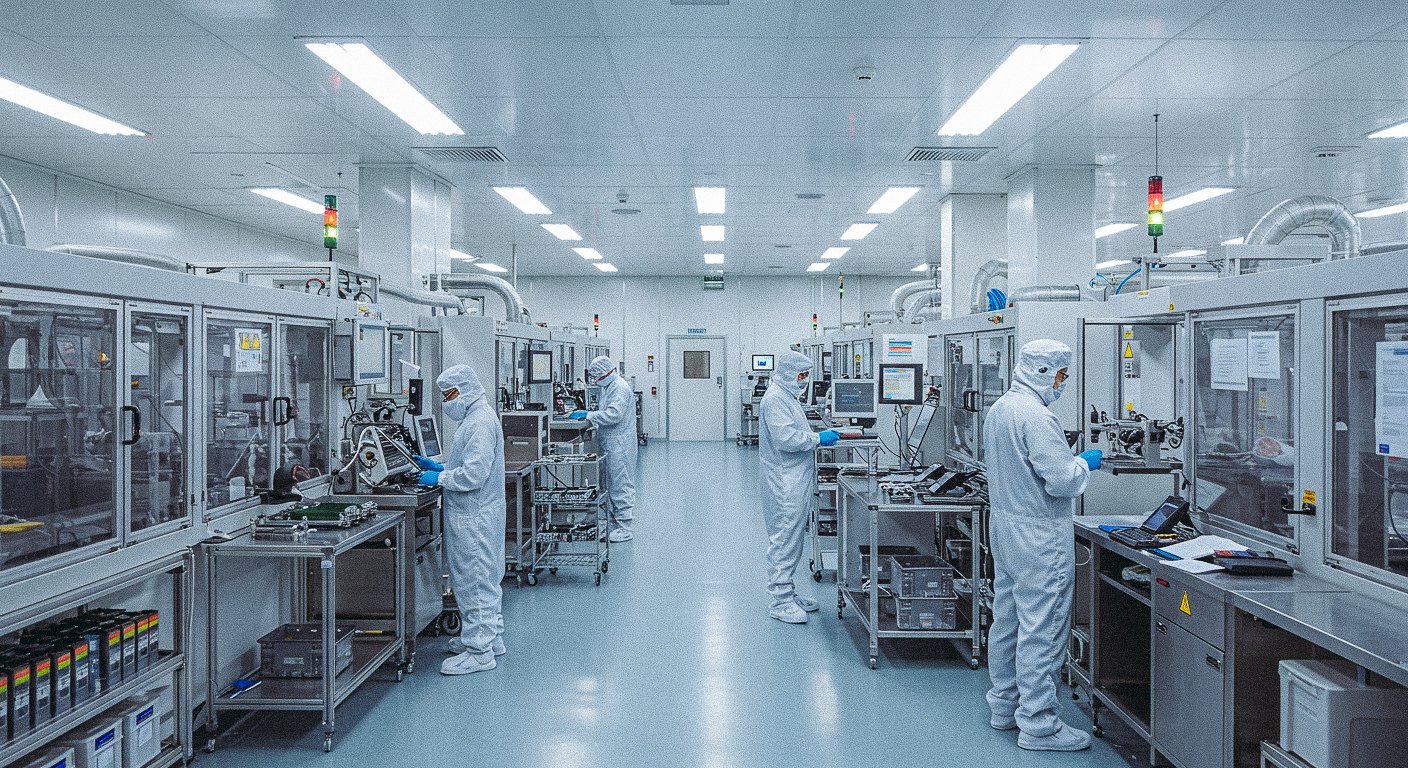

✅ High-tech industry expansion – Investments in semiconductors, AI, and EV batteries

💡 Takeaway: If China’s economy rebounds, consumer goods, technology, and semiconductor industries could see the fastest recovery.

🔹 (2) Possible Hallyu Ban Lift & Its Impact on Korean Businesses

Since 2016, China has imposed restrictions on Korean entertainment, beauty products, and retail due to political tensions. However, recent signs of diplomatic improvement between the two nations suggest that the Hallyu ban may be lifted soon.

📌 Potential Effects of the Ban Lift

✅ Resurgence of K-drama, K-pop, and Korean films in China 🎶🎬

✅ Revival of the duty-free and beauty sectors, driven by Chinese tourism 🛍

✅ Expansion of semiconductor and EV battery partnerships between Korean and Chinese firms 🔋

💡 Takeaway: If the Hallyu ban is lifted, Korean businesses could regain strong footholds in the Chinese market, presenting lucrative investment opportunities.

2. Key Industries & Stocks to Watch After the Hallyu Ban Lift 🏦

🔹 (1) Consumer Goods & Duty-Free – Boost from Chinese Tourism 🛍

✅ Amorepacific (Amorepacific Corporation) – Strong K-beauty brand recognition, expected sales recovery in China

✅ LG Household & Health Care (LG H&H) – Luxury beauty and skincare demand resurgence

✅ Hotel Shilla (Hotel Shilla Co., Ltd.) – Duty-free business revival, increased foot traffic from Chinese visitors

💡 Why It Matters: If Chinese tourists return to Korea, cosmetics and duty-free sectors could see a rapid rebound.

🔹 (2) Entertainment & Media – K-Pop & K-Drama Exports Resume 🎤🎬

✅ HYBE (HYBE Corporation) – Home to BTS, SEVENTEEN, and other top-tier K-pop groups

✅ CJ ENM (CJ ENM Co., Ltd.) – Film, drama, and variety show exports expected to rise

✅ YG Entertainment (YG Entertainment Inc.) – Strong fan base in China with BLACKPINK, BabyMonster

💡 Why It Matters: If K-content restrictions ease, music, film, and live performance sectors could benefit immensely.

🔹 (3) Semiconductors & EV Batteries – Strengthening China-Korea Collaboration 🔋

✅ Samsung Electronics (Samsung Electronics Co., Ltd.) – Increased semiconductor sales as demand recovers

✅ SK Hynix (SK Hynix Inc.) – Potential boost in NAND flash memory and DRAM exports

✅ LG Energy Solution (LG Energy Solution Ltd.) – Rising demand for EV batteries as China promotes green energy

💡 Why It Matters: China remains a critical player in the semiconductor and EV battery markets, making Korea’s top firms well-positioned for future collaboration.

🔹 (4) Automotive & Electric Vehicles – Green Energy Boom 🚗

✅ Hyundai Motor (Hyundai Motor Company) – Expanding EV lineup in China’s fast-growing market

✅ Kia (Kia Corporation) – Strengthening hybrid & EV offerings for Chinese consumers

💡 Why It Matters: With China’s aggressive push for electric vehicles and green energy, Korean automakers could gain a competitive advantage.

3. Investment Strategy – How to Capitalize on China’s Recovery & Hallyu Ban Lift? 💹

✅ Short-Term Investment Strategy

✔ Watch for news on Hallyu ban policies and focus on entertainment, beauty, and tourism stocks

✔ Identify key economic indicators that signal China’s consumer spending recovery

✅ Long-Term Investment Strategy

✔ Focus on semiconductors, EV batteries, and high-tech industries, which are critical to China’s economic growth

✔ Consider Korean companies with strong partnerships in China, as collaboration between the two economies expands

💡 Takeaway: Short-term opportunities lie in consumer and entertainment industries, while long-term growth is expected in semiconductors and EV sectors.