The semiconductor industry is the backbone of modern technology, powering everything from AI and 5G networks to autonomous vehicles and cloud computing. As we head into 2025, the market is expected to experience a major shift driven by rising demand for AI chips, geopolitical tensions, and breakthroughs in semiconductor manufacturing.

This article explores key industry trends, the competitive landscape between Samsung Electronics and TSMC, and the critical role of ASML’s EUV lithography technology. If you’re an investor looking to capitalize on the next big opportunities in the semiconductor market, read on!

1. Will 2025 Mark the Beginning of a New Semiconductor Supercycle? 🔍

The semiconductor market is known for its cyclical nature, with alternating periods of boom and slowdown. The industry faced headwinds in recent years due to global economic uncertainties and declining consumer electronics demand. However, 2025 is expected to usher in a new growth phase.

📌 What’s driving the semiconductor industry’s resurgence?

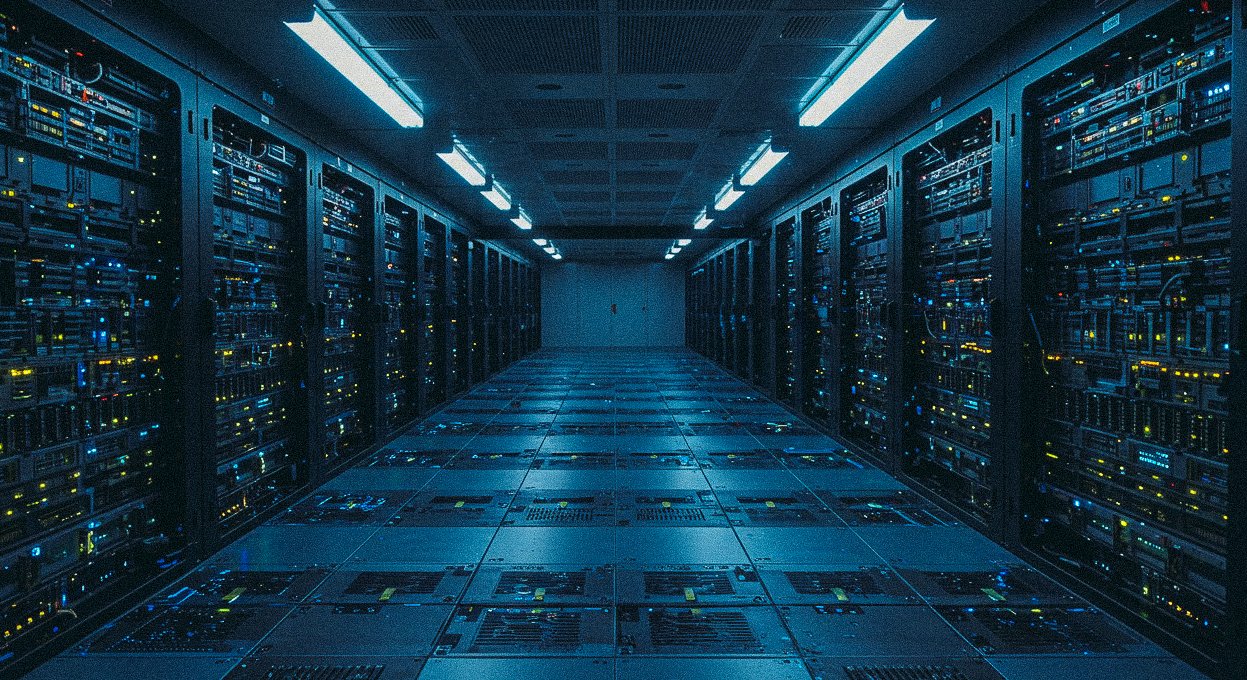

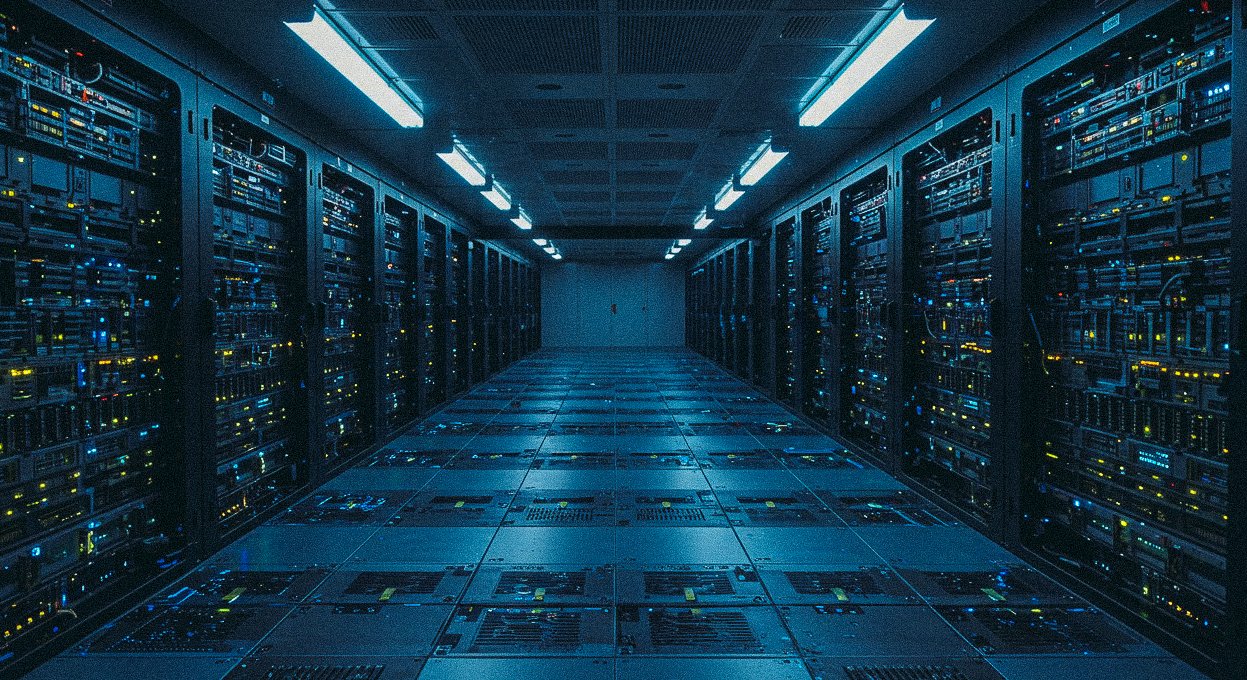

✔ Surging AI chip demand – The rapid expansion of AI applications in data centers, self-driving cars, and robotics is fueling demand for high-performance semiconductors.

✔ U.S.-China tech war intensifies – With both nations investing heavily in domestic semiconductor production, global supply chains are being reshaped.

✔ 2nm process node era begins – The shift toward more advanced fabrication technologies is expected to enhance chip performance and energy efficiency.

💡 Investment takeaway: The semiconductor sector is poised for long-term growth, making it an attractive area for strategic investment.

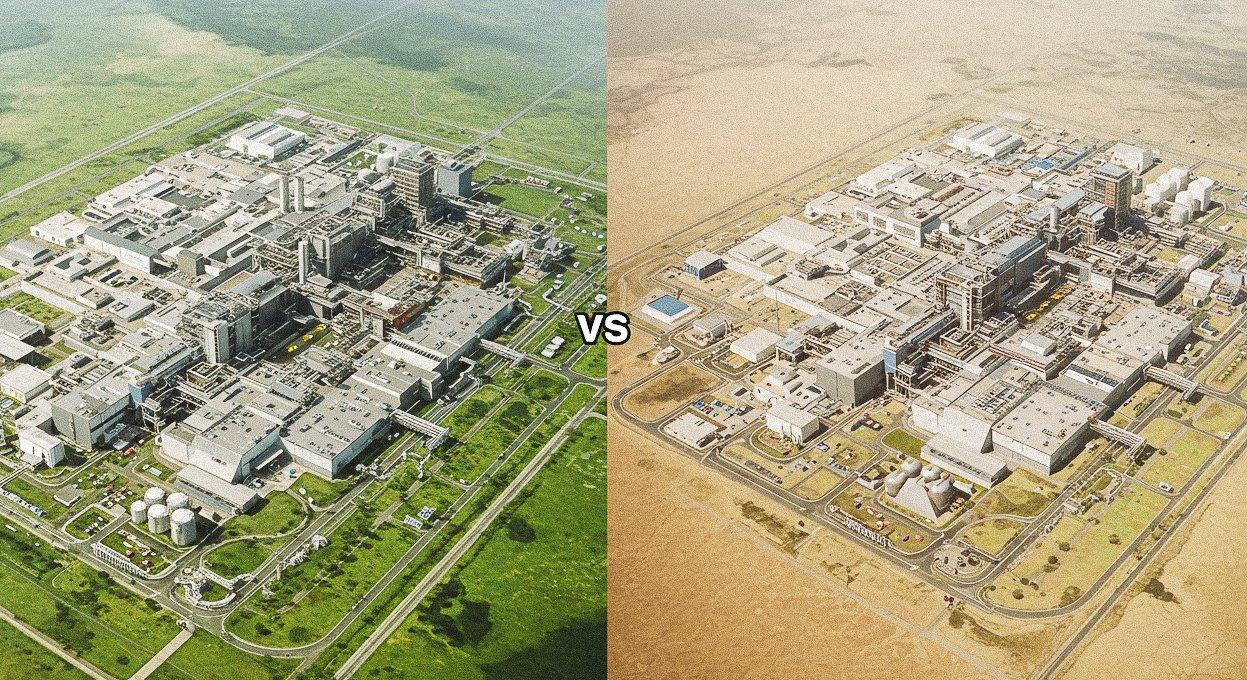

2. Samsung vs. TSMC: The Race for 2nm Leadership

The competition between Samsung and TSMC is heating up as both companies vie for dominance in the 2nm semiconductor manufacturing space.

📌 Samsung’s strengths

🔹 Gate-All-Around (GAA) transistor technology – A next-generation design that improves power efficiency and performance compared to traditional FinFET transistors.

🔹 Expanding foundry capacity in the U.S. – Samsung’s new $17 billion fabrication plant in Texas is expected to strengthen its position in the global semiconductor supply chain.

📌 TSMC’s strengths

🔹 Higher yield rates and production stability – TSMC has a proven track record of delivering reliable chip production, attracting major clients like Apple, NVIDIA, and AMD.

🔹 Diversified manufacturing footprint – With new fabs in Arizona, Japan, and Germany, TSMC is mitigating risks associated with geopolitical uncertainties.

💡 Investor insight: While TSMC currently holds the lead in market share, Samsung is aggressively innovating and expanding its presence in the U.S., making it a company to watch closely.

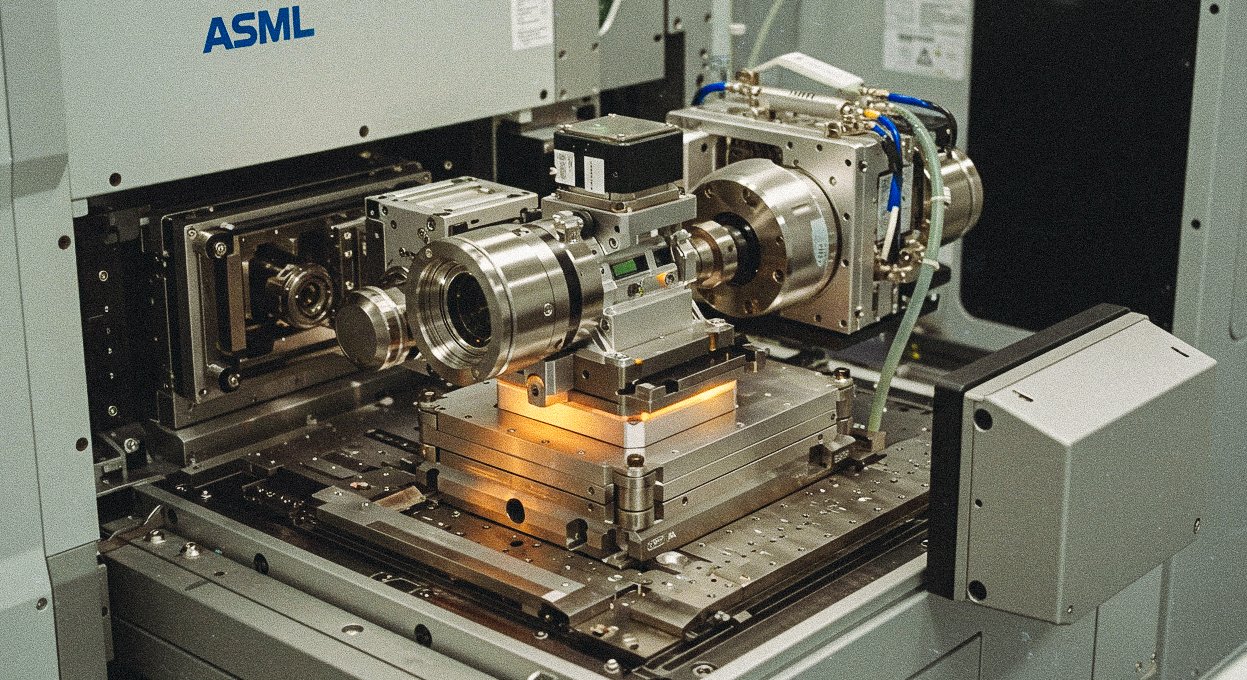

3. Why ASML is the Most Critical Player in Semiconductor Manufacturing 🏭

ASML, the Dutch company that dominates the extreme ultraviolet (EUV) lithography market, is the only manufacturer capable of producing EUV machines needed for 2nm and smaller chips.

✔ EUV lithography is essential for next-gen chipmaking – Companies like Intel, TSMC, and Samsung depend on ASML’s machines to manufacture cutting-edge semiconductors.

✔ A monopoly in a high-demand market – ASML’s EUV machines cost over $200 million each, and demand continues to outstrip supply.

✔ Revenue model beyond hardware – ASML generates steady income from servicing and software updates, making it a resilient investment choice.

💡 Investment takeaway: ASML is one of the most strategic semiconductor stocks for long-term investors, as its technology is indispensable to the industry.

4. How to Invest in the Semiconductor Market in 2025 💰

Given the long-term potential of the semiconductor industry, investors should consider diversifying their portfolios across different segments of the supply chain.

✔ Focus on long-term trends – Despite short-term volatility, the semiconductor market is expected to grow due to AI, cloud computing, and 5G expansion.

✔ Balance between memory and foundry investments – Investing in both memory chip leaders (Samsung, Micron) and foundry giants (TSMC, Intel) can provide balanced exposure.

✔ Don’t overlook semiconductor equipment makers – Companies like ASML, Applied Materials, and Lam Research are critical to the industry’s future growth.

📌 Recommended semiconductor portfolio for 2025:

✅ NVIDIA (AI chip leader)

✅ TSMC (Leading foundry)

✅ Samsung Electronics (Memory + Foundry)

✅ ASML (EUV lithography leader)

✅ Applied Materials (Key semiconductor equipment supplier)

5. Conclusion: Where Are the Biggest Opportunities in 2025? 🌟

The semiconductor market is entering an exciting phase, driven by:

🔹 Samsung vs. TSMC’s 2nm battle – Who will take the lead in the next-generation foundry market?

🔹 ASML’s continued dominance – EUV lithography remains a bottleneck, ensuring steady demand for ASML’s technology.

🔹 AI, autonomous driving, and 5G as growth drivers – These trends will keep semiconductor demand strong for years to come.

💡 Final takeaway: Semiconductors are a long-term growth sector. While short-term fluctuations may occur, investors with a strategic approach can benefit from this high-potential industry. 🚀