The U.S. stock market offers some of the best long-term investment opportunities, especially in sectors driven by technological advancements, healthcare innovation, and sustainability efforts. If you’re looking for high-growth sectors with strong future potential, artificial intelligence (AI), biotechnology, and green energy are three areas you should seriously consider.

In this article, we’ll explore why these sectors are booming, the top companies to watch, and smart investment strategies to maximize returns. 📈

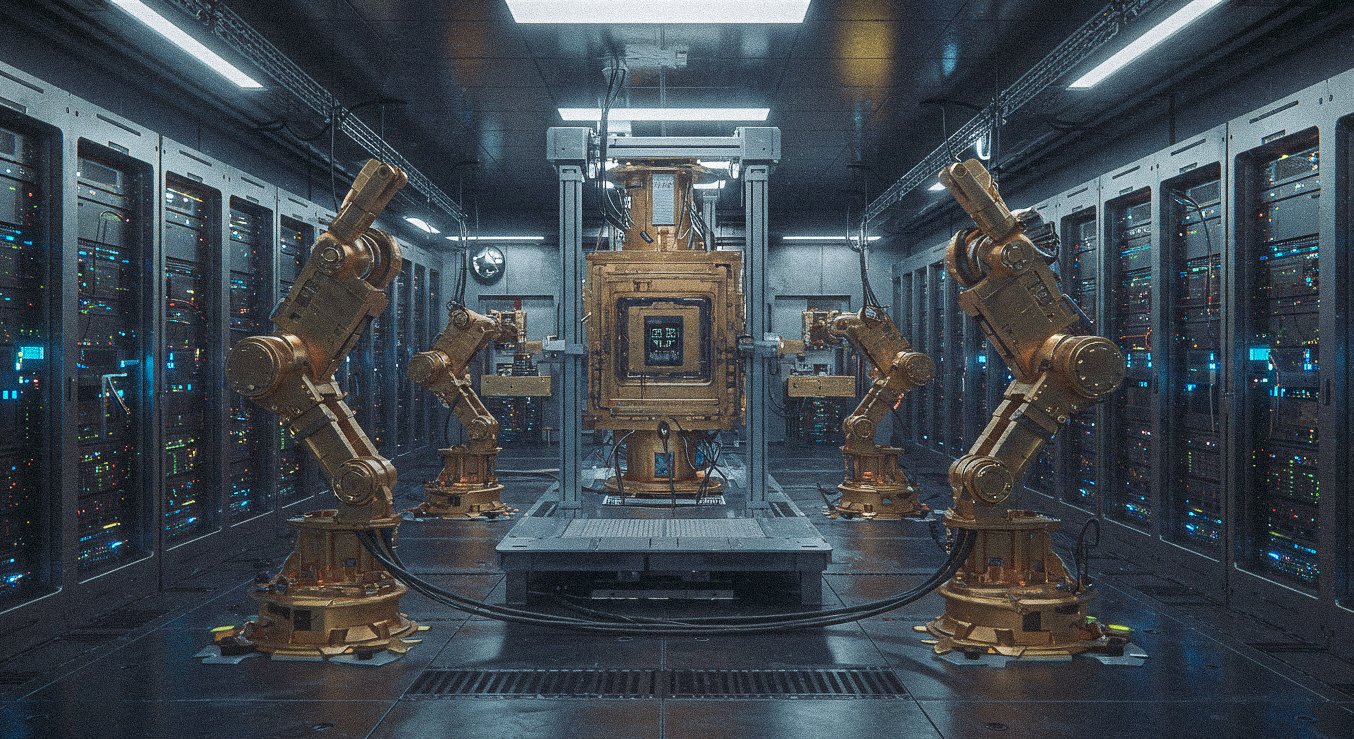

1. AI (Artificial Intelligence) – The Core of the Fourth Industrial Revolution 🤖

AI is no longer a futuristic concept—it’s an essential part of our daily lives and business operations. From AI-powered data centers to autonomous vehicles and cloud computing, this sector is expanding rapidly.

🔹 Why AI is a Must-Have Investment

✔ Generative AI Boom – ChatGPT, Google Bard, and other AI models are reshaping industries from marketing to software development.

✔ Explosive Demand for AI Chips – NVIDIA, AMD, and Intel are leading the race to develop high-performance AI processors.

✔ Big Tech Investing Heavily in AI – Microsoft, Amazon, and Alphabet are integrating AI across cloud computing, search engines, and automation.

🔹 Top AI Stocks to Watch

✅ NVIDIA (NVDA) – The undisputed leader in AI chip technology, dominating the GPU and AI semiconductor market.

✅ Microsoft (MSFT) – A major AI investor, leveraging AI in cloud computing and business applications through its partnership with OpenAI.

✅ Palantir (PLTR) – A key player in AI-driven data analytics, supplying AI-powered solutions to governments and enterprises.

💡 Investment Takeaway: AI is driving the future of technology. A well-balanced portfolio should include AI-focused semiconductor, cloud computing, and software companies.

2. Biotech – Revolutionizing Healthcare 🧬

The biotech industry is at the forefront of medical innovation, with breakthroughs in gene editing, personalized medicine, and AI-driven drug discovery leading to major advancements in healthcare.

🔹 Why Biotech is a High-Potential Sector

✔ Aging Population Increases Healthcare Demand – Longer life expectancy means higher demand for pharmaceuticals and advanced medical treatments.

✔ AI-Driven Drug Discovery – AI is significantly reducing the time and cost needed to develop new drugs.

✔ Breakthroughs in Gene Therapy and Immunotherapy – CRISPR technology and personalized cancer treatments are changing the medical landscape.

🔹 Top Biotech Stocks to Watch

✅ Moderna (MRNA) – Pioneering mRNA technology, expanding beyond vaccines to treatments for cancer and rare diseases.

✅ CRISPR Therapeutics (CRSP) – Leading in gene-editing treatments for genetic disorders and chronic diseases.

✅ Johnson & Johnson (JNJ) – A stable, diversified healthcare company with a strong pharmaceutical and medical devices segment.

💡 Investment Takeaway: While biotech stocks can be high-risk, high-reward, investing in companies with strong research pipelines and FDA approvals can provide long-term gains.

3. Green Energy – The Future of Sustainability 🌿

The global push toward carbon neutrality is accelerating investments in renewable energy, electric vehicles (EVs), and clean technology. Governments worldwide are offering tax incentives and subsidies to encourage sustainable energy adoption.

🔹 Why Green Energy is a Key Investment Sector

✔ Booming EV Market – Tesla, Rivian, and legacy automakers are ramping up EV production.

✔ Government Incentives for Clean Energy – The U.S. Inflation Reduction Act is fueling rapid investment in solar, wind, and energy storage.

✔ ESG Investing on the Rise – More investors are prioritizing companies with strong environmental, social, and governance (ESG) initiatives.

🔹 Top Green Energy Stocks to Watch

✅ Tesla (TSLA) – The market leader in EVs, expanding into energy storage and battery technology.

✅ NextEra Energy (NEE) – The largest renewable energy company in the U.S., focusing on wind and solar power.

✅ Enphase Energy (ENPH) – A top innovator in solar energy technology and energy storage solutions.

💡 Investment Takeaway: Green energy stocks can be volatile, but they offer long-term potential as the world transitions away from fossil fuels.

4. Conclusion: Where Should You Invest in 2025?

📌 AI, biotech, and green energy are three of the most promising growth sectors in the U.S. stock market.

📌 Big Tech and innovative startups are leading the charge in each of these industries.

📌 While short-term volatility is possible, a long-term investment approach can yield significant returns.

💡 Suggested Portfolio Allocation

✅ AI → NVIDIA (NVDA), Microsoft (MSFT)

✅ Biotech → Moderna (MRNA), CRISPR Therapeutics (CRSP)

✅ Green Energy → Tesla (TSLA), NextEra Energy (NEE)

By investing in these high-growth sectors, you can position yourself for success in the evolving U.S. stock market! 🚀