As the electric vehicle (EV) industry rapidly expands, the battery sector has emerged as one of the most promising investment opportunities. With global EV sales surging and governments pushing for greener energy solutions, the demand for advanced battery technology is skyrocketing.

However, not all battery companies are set to thrive. Which companies will dominate the market over the next five years? Today, we’ll analyze five high-growth battery companies and explore why they could be game-changers for investors.

📈 Why Invest in the Battery Industry?

Batteries play a crucial role in the EV revolution, energy storage systems (ESS), and consumer electronics. The transition to clean energy and EV adoption is fueling unprecedented demand for innovative battery solutions.

✅ Rapid EV Growth: Global EV sales are projected to grow at a CAGR of over 20% through 2030.

✅ Government Incentives: The U.S., Europe, and China are increasing subsidies and tax incentives to boost battery production.

✅ Breakthroughs in Battery Technology: Next-generation batteries, including solid-state batteries, promise higher efficiency and better safety.

Now, let’s dive into the top 5 battery companies poised for substantial growth over the next five years.

🏆 Top 5 High-Growth Battery Stocks for the Next 5 Years

1️⃣ LG Energy Solution (LGES) 🔋

LG Energy Solution is one of the largest battery manufacturers globally, with a strong presence in North America, Europe, and Asia.

🔹 Key Strengths

- Major supply agreements with GM, Tesla, and Ford.

- Expanding U.S. battery production facilities to capitalize on the Inflation Reduction Act (IRA).

- Heavy investment in solid-state battery technology for next-gen EVs.

🔹 Growth Outlook

With an estimated 25%+ annual revenue growth through 2028, LGES is well-positioned to strengthen its dominance in the global EV battery market.

2️⃣ Samsung SDI ⚡

Samsung SDI specializes in high-performance EV batteries and is actively investing in solid-state battery technology.

🔹 Key Strengths

- Key supplier for BMW, Volkswagen, and Stellantis.

- Expected to unveil its first solid-state battery prototype by 2025.

- Focuses on premium, high-value battery solutions for luxury EV brands.

🔹 Growth Outlook

Samsung SDI’s premium battery market focus and next-gen battery innovations position it for strong long-term growth.

3️⃣ CATL (Contemporary Amperex Technology) 🏭

China’s CATL is the world’s largest EV battery producer, holding the biggest market share in global battery production.

🔹 Key Strengths

- Supplies batteries to Tesla, Hyundai, BMW, and Mercedes-Benz.

- Industry leader in LFP (lithium iron phosphate) battery technology, offering lower-cost, high-durability solutions.

- Backed by strong Chinese government support for domestic battery production.

🔹 Growth Outlook

With market dominance and continuous innovation, CATL is expected to maintain its leadership position while expanding further into Europe and North America.

4️⃣ SK On 🚗

SK On is an emerging player in the global EV battery market, rapidly expanding its manufacturing footprint.

🔹 Key Strengths

- Strong partnerships with Hyundai, Ford, and Volkswagen.

- Expanding battery production in the U.S., benefiting from IRA incentives.

- Plans to introduce solid-state battery prototypes by 2025.

🔹 Growth Outlook

SK On is projected to achieve 30%+ annual growth through 2027, with a significant focus on scaling production in North America.

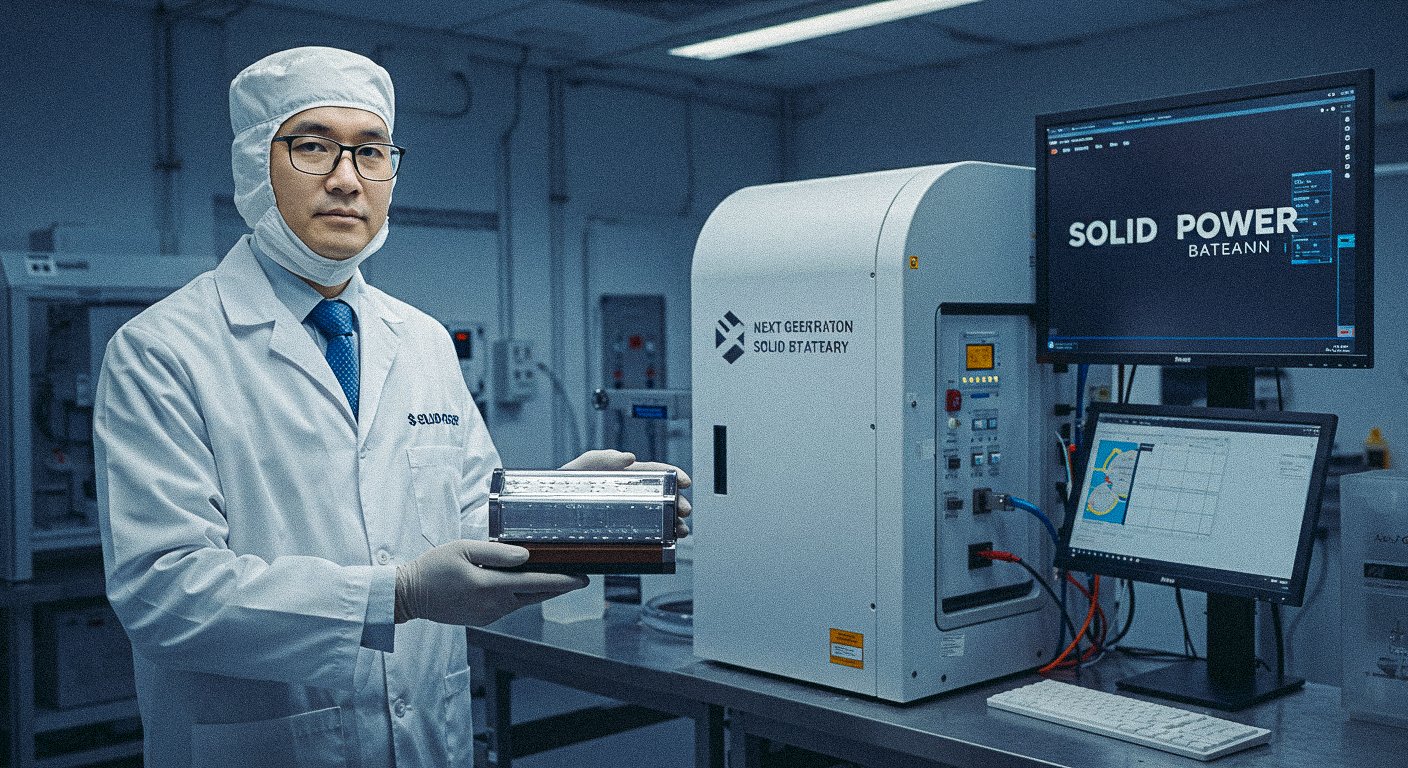

5️⃣ Solid Power 🔬

Solid Power is at the forefront of solid-state battery technology, aiming to revolutionize the industry with safer and more efficient battery solutions.

🔹 Key Strengths

- Pioneer in solid-state battery development.

- Partnered with Ford and BMW to commercialize next-gen batteries.

- Claims its technology increases energy density by over 50% compared to conventional lithium-ion batteries.

🔹 Growth Outlook

As solid-state battery technology becomes mainstream by 2028 and beyond, Solid Power could emerge as a key player in the next-generation battery industry.

🔍 How to Invest in the Battery Sector

✅ Track EV Market Growth Trends

✅ Monitor Battery Technology Advancements (Solid-State, LFP, etc.)

✅ Analyze Government Policies & Incentives in Key Markets

The battery sector is a long-term investment opportunity, but success depends on identifying companies with strong R&D, production capacity, and strategic partnerships.

🚀 Conclusion: Is Now the Right Time to Invest in Battery Stocks?

With the EV market booming and battery demand surging, now is a crucial time to consider battery investments. However, not all companies will succeed—investors should focus on firms with a strong technological edge, scalable production, and global expansion plans.

📌 Investment Checklist

✅ Invest in companies with long-term growth potential.

✅ Keep an eye on solid-state battery technology developments.

✅ Stay updated on global market policies and regulations.