The stock market has long debated between growth stocks and value stocks as the best investment strategy. Growth stocks offer the potential for high returns, driven by rapid expansion and innovation, while value stocks provide stability and dividends, often at a lower valuation.

With shifting interest rates, economic trends, and market dynamics, 2025 presents unique opportunities and challenges for investors. In this article, we’ll analyze the U.S. market outlook and explore the best investment strategy for the year ahead.

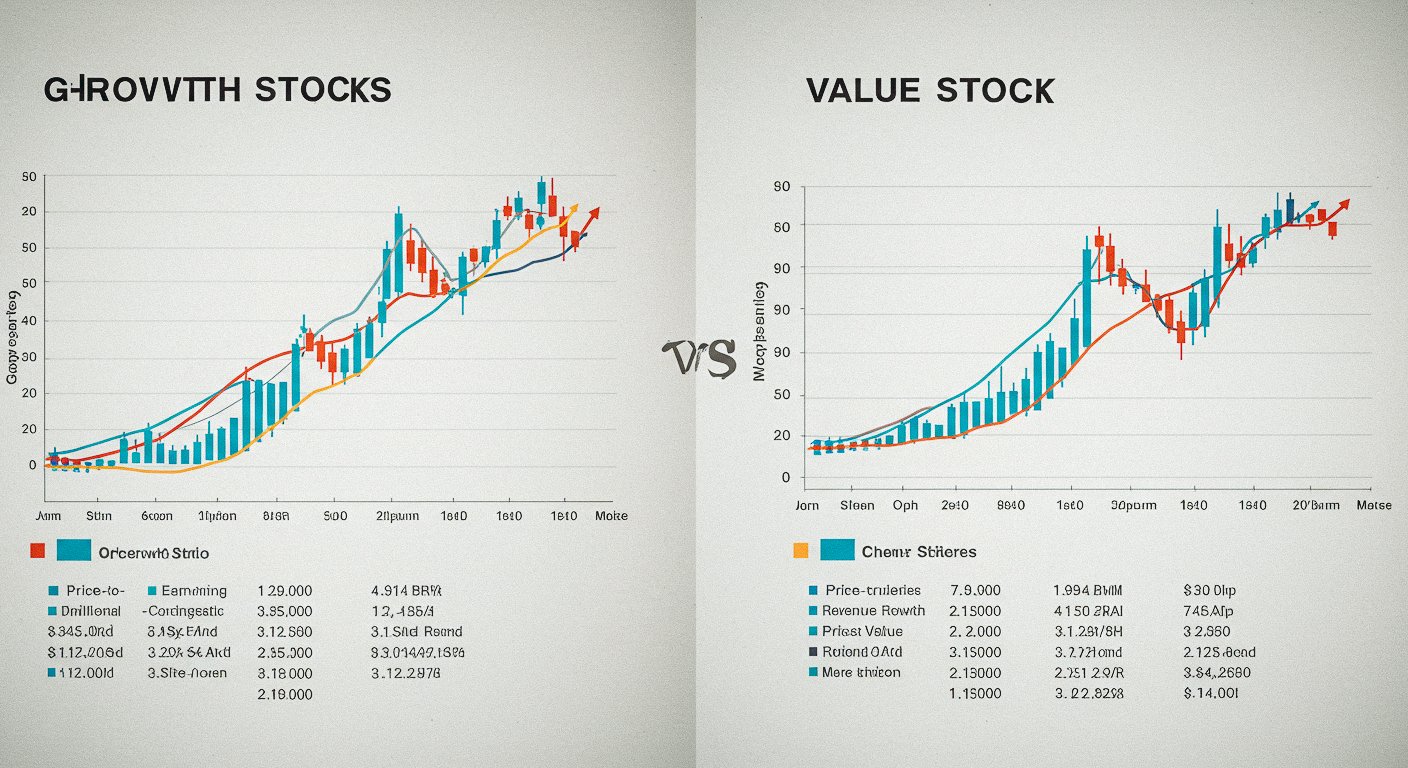

1. Growth Stocks vs. Value Stocks: Key Differences

What Are Growth Stocks?

📌 Companies with high revenue and earnings growth potential

📌 Primarily in tech, AI, EVs, and biotech sectors

📌 Reinvest profits instead of paying dividends

📌 Examples: NVIDIA, Tesla, Amazon, Microsoft

What Are Value Stocks?

📌 Undervalued companies with stable earnings

📌 Found in financials, consumer goods, and industrials

📌 Higher dividend yields, lower price-to-earnings (P/E) ratios

📌 Examples: Coca-Cola, Johnson & Johnson, JPMorgan Chase

2. U.S. Market Outlook for 2025

📉 Federal Reserve’s Interest Rate Decisions

The Federal Reserve (Fed) aggressively raised interest rates in 2022–2023 to combat inflation. As inflation moderates, rate cuts are expected, which historically favor growth stocks.

✅ Lower interest rates → Growth stocks rally

✅ Flat or high interest rates → Value stocks remain strong

🌍 Geopolitical and Economic Uncertainty

- The ongoing Ukraine-Russia conflict and U.S.-China trade tensions continue to create market volatility.

- In uncertain times, value stocks with strong balance sheets and consistent dividends tend to perform better.

🤖 Technology Sector Dominance

- AI, semiconductors, and cloud computing are expected to lead market growth in 2025.

- NVIDIA, AMD, and Microsoft remain top players in the AI-driven economy.

3. Growth vs. Value: Which Stocks to Invest in for 2025?

Growth Stock Investment Considerations

✅ AI, semiconductor, and cloud computing sectors remain attractive

✅ Rate cuts could drive tech stock gains

✅ Be cautious of overvalued stocks with weak fundamentals

Value Stock Investment Considerations

✅ Dividend-paying consumer and financial stocks offer stability

✅ Defensive sectors (healthcare, utilities) provide protection in downturns

✅ Growth stock corrections could increase demand for value stocks

4. Market Data & Portfolio Allocation Strategy

📊 Recent Market Performance (2023–2024):

✔ Nasdaq (growth stock-heavy) up ~40%

✔ Dow Jones (value stock-heavy) up ~10–15%

✔ Average dividend yield for value stocks: 3–5%

📌 Suggested 2025 Portfolio Strategy:

🔹 60–70% Growth Stocks (Tech, AI, Semiconductors)

🔹 20–30% Value Stocks (Dividend and defensive plays)

🔹 10–20% Cash Reserves (Hedge against volatility)

5. Conclusion: A Balanced Investment Strategy for 2025

With interest rate cuts likely on the horizon, growth stocks may have an edge in 2025, particularly in the AI and semiconductor industries. However, economic and geopolitical uncertainties make value stocks a necessary part of a well-diversified portfolio.

💡 Key Investment Takeaways:

✅ Focus on high-growth sectors (AI, cloud, semiconductors)

✅ Include dividend-paying stocks for stability

✅ Maintain cash reserves to manage volatility

The key to success in 2025 will be staying informed, adapting to market conditions, and maintaining a diversified approach.